All new home buyers should comply with the whole 4 Fs of building a brand new home, i.e., finishes, fixtures, fittings, and the most crucial – finances! Finance being the most important aspect of it all. Not many people are well versed with the puzzle of construction financing and subsidiary factors that come into play when you are building a brand new home in city hubs like Sydney.

The average cost of building a brand new home in Australia stands somewhere in between 300K to 330K. Almost everyone requires external funding for a project like building a house. In this blog, we will discuss everything you need to know about home construction loans from what they exactly entail to how to obtain them to finance your dream home in Sydney. These loans not only cover building a home from scratch, but also knockdown rebuild projects as well as home renovations!

Keep reading to find out more!

What Are Home Construction Loans?

Home construction loans differ from other loan types. Such loans allow beneficiaries to pull out money progressively in installments during the duration of their ongoing project. All they have to do is keep paying the interest for the amount they are drawing and not the entire sanctioned amount. These installments are usually called progress payments or progressive drawdowns.

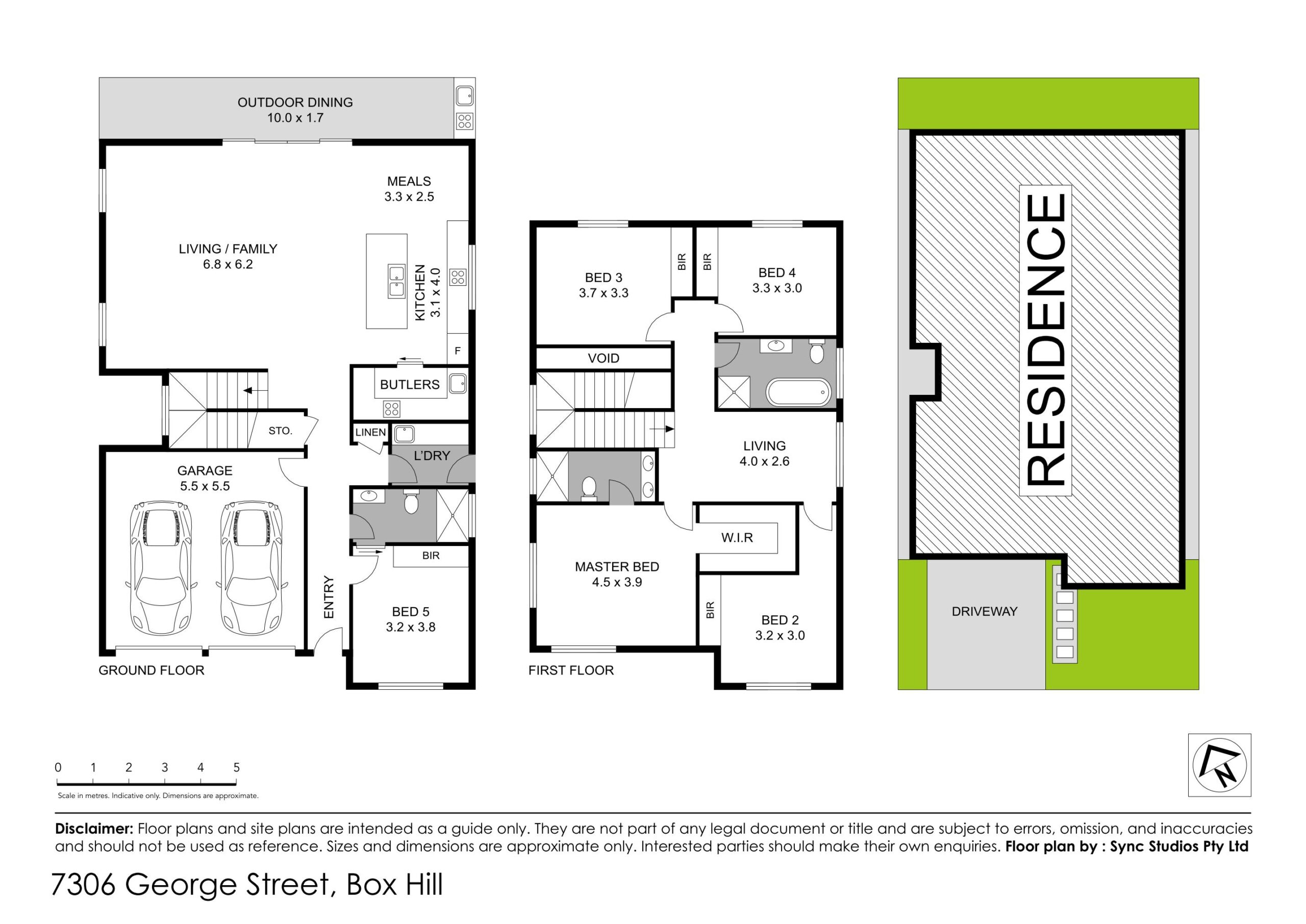

Usually banks allow borrowers to draw about 6 to 7 installments from the total amount. However, the beneficiary can only apply for an installment on the basis of the invoice provided by the concerned builder. Finally, the beneficiary does not have to start paying the lender back the construction mortgage until the project is entirely completed. So you can build your dream home according to the house layouts in Sydney before tackling the task of repaying the loan.

Construction Loan Requirements: Prerequisites Before Applying

We have listed down the basic construction loan requirements that you need to fulfill to even become eligible to apply for one.

A Council Approval

First things first! You will need to seek an approval on the design plans for your project from your zone council. If the design plans meet all the requirements as well as complying with all the regulations, then you should have no issues getting approved!

Also Read: Top 5 Common Home Building Mistakes to Avoid

A Building Contract

A building contract is a detailed documentation of the entire construction process. It comprises the different stages of construction, its duration, and the final price of the entire project. This allows the lender to be prepared to pay the builder as and when it gets an invoice from the beneficiary, in order to allow for successful construction financing.

Building Specifications

The type of material, the quality of your inclusions, etc., such factors have a significant impact on the final valuation of the cost of the project. Thus, they become an important part of the construction mortgage. This is why borrowers need to submit building specifications to the lender for construction financing.

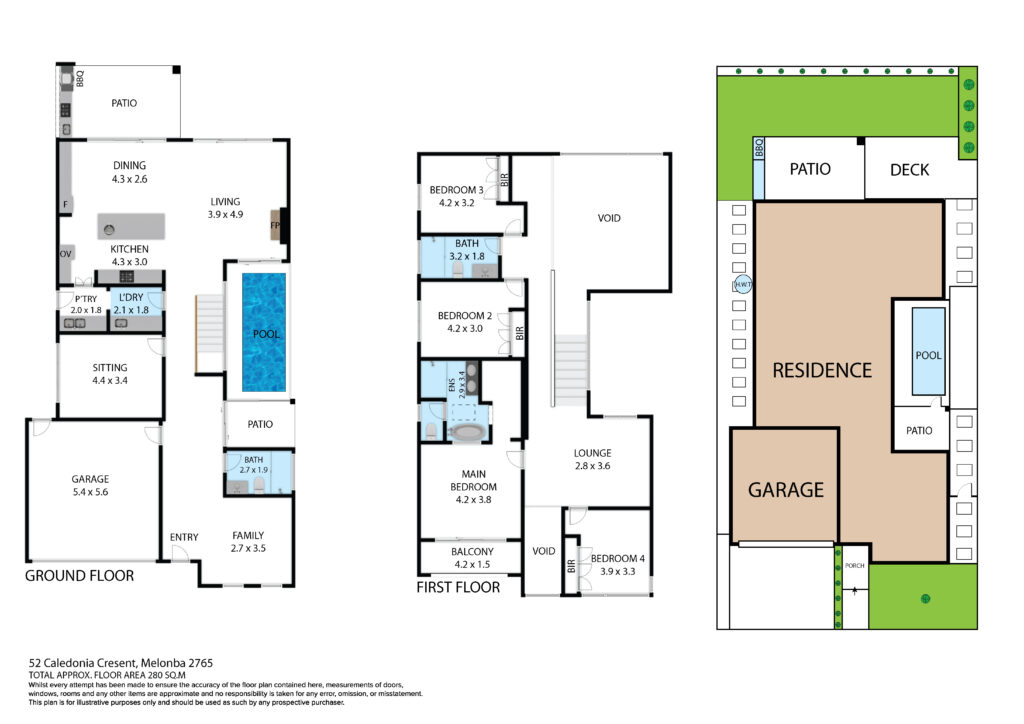

Quotes For Any Subsidiary Expenditures

Additional works such as addition of a swimming pool, shedding, landscaping, etc., are not included in the building contracts most often. Thus, you have to make sure you are providing your lender with their quotes in order to include their cost in your construction mortgage. Since these upfront works do not require any approval from the council, they are not mentioned in the building plans.

Other

There are a few other important documents that you need to keep ready before applying for financing in order to avoid any roadblocks that may come your way. These documents include building contract signed by both parties, i.e., the builder and the owner, a quantity surveyor report, and most importantly, builders insurance. If you have these documents ready with you, you are making a strong case for yourself!

Conclusion

We understand that the process of construction financing can be very daunting, however, you can follow this guide to make sure you are doing everything right! Take the first step towards building your dream home in Sydney.

Thanks for reading!