Investing in real estate can be a profitable venture, but there are certain considerations that one should make before investing. One of them is the chance of being able to buy properties when they are in foreclosure. This option makes it possible for aspiring investors to buy commercial properties that may be devalued or have issues with the current owner. Learn about how foreclosed homes can provide an investment opportunity, and where you might want to avoid if you’re thinking about making an investment in this type of property.

What is Foreclosure?

Foreclosure is the process of a property becoming delinquent in its mortgage payments. The lender may then take legal action to have the property sold, usually through a foreclosure auction. Foreclosure can have serious consequences for homeowners, including loss of equity in their home, increased home insurance premiums, and difficulty obtaining new financing.

There are several factors to consider when deciding whether or not buying a foreclosed home is a good investment strategy. First, it’s important to understand the difference between a foreclosed property and a distressed property.

These properties have been sold through an official foreclosure auction, while a distressed property is one that is likely to become foreclosed but has not yet been auctioned off. A foreclosed property may still have some potential value if the homeowner can negotiate a lower sale price with the lender or find another buyer who is willing to pay more for the property. Distressed properties, on the other hand, often have little value and are best avoided unless you are very familiar with the housing market and want to take on the risk of buying something that may not be worth anything at all later on.

Another important factor to consider is whether or not you will need to make any repairs or updates to the property before you can move in. If this is the case, you will have to decide whether or not it is cost-effective for you to make these upgrades because, in most cases, they are much more expensive than buying a new home. While making necessary improvements and repairs can save you money if your goal is to simply flip the house quickly and get rich, it may be wiser to buy local town homes property that has already been renovated and then sell it at a profit later on rather than investing time and money into renovations that may not net you any income anyway.In addition to the condition of the property itself, there are other things that should go into consideration when deciding whether or not a foreclosed property makes sense as a real estate investment opportunity

How to Find a Foreclosed Home Which Is Right For You

There are a few things you need to consider before buying a foreclosed home.

First, make sure you are aware of the risks associated with these properties. Foreclosed houses typically have higher levels of debt and foreclosure related problems than other homes. Before investing in one, be sure to do your research and weigh the potential rewards against the potential risks.

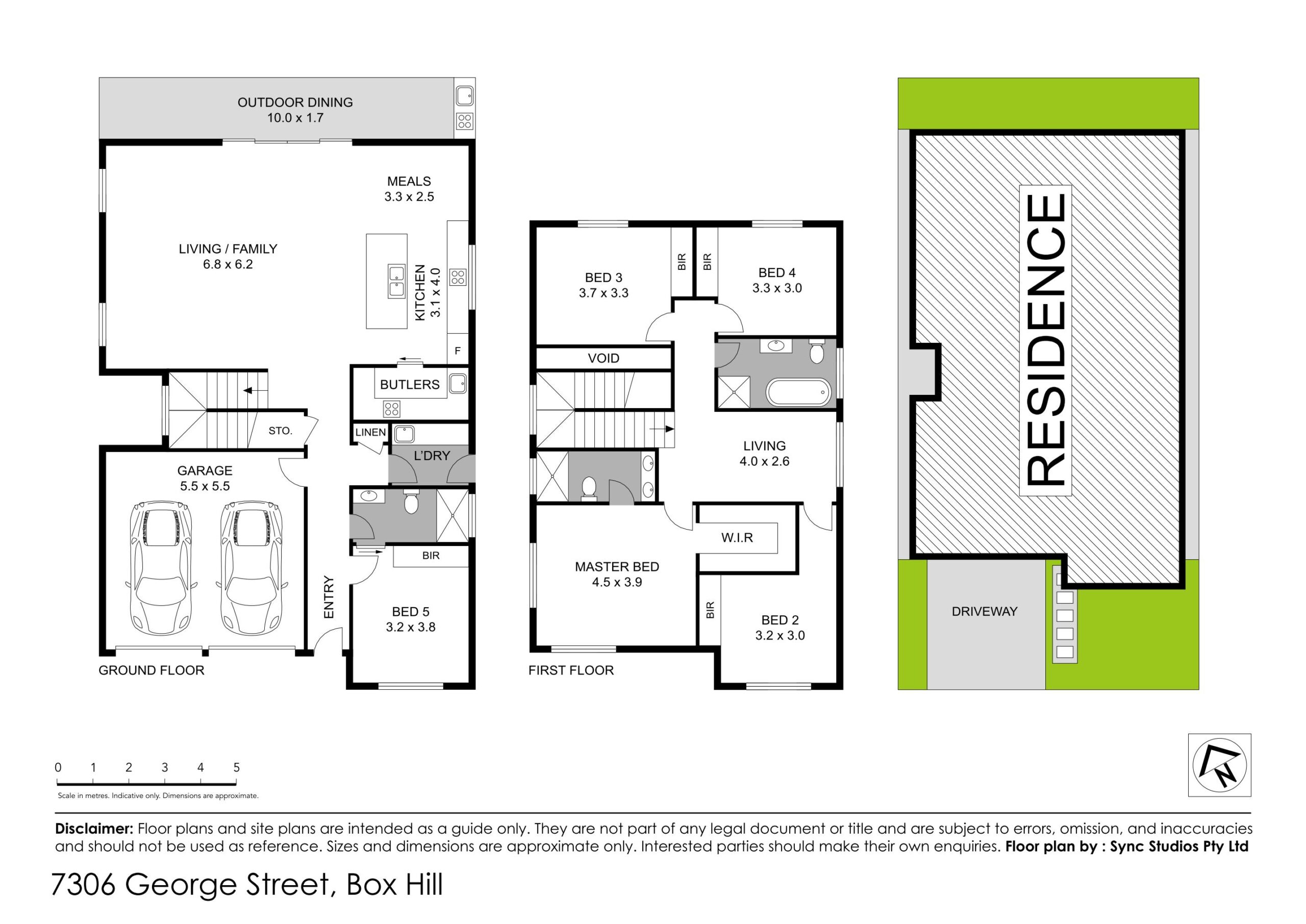

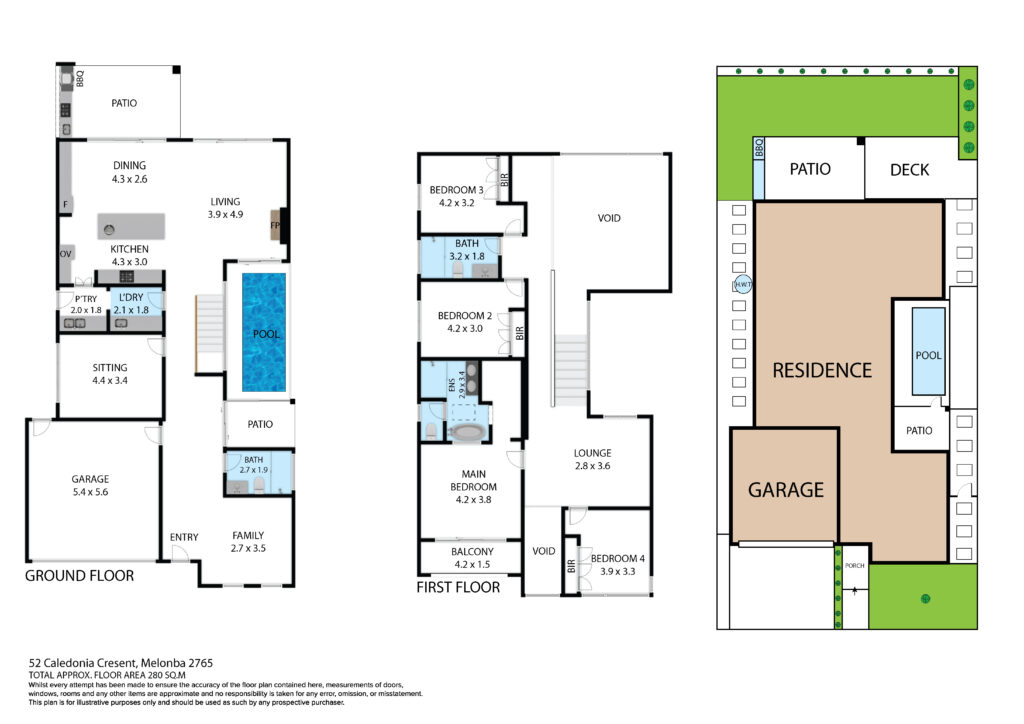

Second, know what type of property you are looking for. These types of homes can come in all shapes and sizes, from small single-storey homes to large luxury homes. Make sure you understand the specifics of the property you are considering before making an offer.

Third, be prepared to spend some time investigating the property. Foreclosed houses can be difficult to inspect and may have been damaged by previous owners or foreclosure proceedings. Be prepared to spend a lot of time on your own (and possibly with a real estate agent) touring the property before making an offer.

Fourth, be prepared to spend money on repairs and renovations if you decide to buy a foreclosure home. Foreclosed homes often have significant damage, and it will likely cost more than buying a regular home to fix them up properly. Make sure you have enough money saved up to cover these costs.

Checking the Foreclosed Home’s Credit Scores

If you’re thinking about buying a foreclosure, it’s important to do your research first. Many banks and credit agencies are strict about who they’ll approve for a mortgage on a foreclosed home, and your credit score will be a key factor in whether you get approved. Here are some tips to check the credit score of a foreclosure:

1. Check with the public records office in your county. This is where you’ll find the foreclosure deed, which will have the property’s full credit score recorded.

2. Check with credit bureaus themselves. They usually have databases of all publicly available credit information, including credit scores.

3. Check with free websites that offer free credit reports, such as Credit Karma or Credit Sesame.

4. Use a credit scoring calculator to see what your score would be if the property were yours to borrow on. Most lenders use FICO scores, so this will give you an idea of where you stand relative to others who may have recently bought foreclosures.

Pros and Cons of Buying Foreclosed Properties

There are pros and cons to buying a foreclosed home, depending on your specific situation.

Pros

- These properties are usually cheaper than comparable homes in the same area.

- They may have lower mortgage payments than regular homes.

- They may have been well maintained by the previous owners and may require less work than regular homes.

- It may have already been inspected and may be in better condition than comparable homes that are not foreclosures.

- These properties may have good rental potential if properly maintained.

- If you are able to get a good loan for the property, buying a foreclosed property could be a great investment strategy.

Cons

- It may require more time and effort to purchase and/or maintain than regular homes.

- There is always the risk of purchasing a property that is not actually in good condition or that has been damaged by neglect or vandalism.

- If you are not able to get a good loan for the property, purchasing a foreclosed property could be a very costly mistake.

Conclusion

When it comes to buying foreclosed houses, there are a few things you need to consider. First and foremost, you need to make sure that the property is actually foreclosed on – if it’s not, the price you pay will likely be much higher than what you would receive if the house were sold as-is. Second, you need to understand how long it might take for the house to sell – again, this will depend on factors like the condition of the property and whether any repairs or updates have been made. Finally, remember that foreclosure prices are usually much lower than market rates, so don’t expect to get rich overnight by purchasing a foreclosed home – instead, aim for properties in good condition that will appreciate over time.